Everyone knows that India Pale Ale (IPA) is a dominant force nationally for small and independent craft brewers, but how much variation is there in style preferences across the states? Does the West Coast really love IPAs that much more than the rest of the country? Which styles have higher share in more developed craft states?

To answer these questions, I turned to some state-by-state style data from the IRI Group. Before going further, a couple of notes on this data:

- IRI’s newly restated craft definition has some significant differences from the Brewers Association category, namely the inclusion of Anheuser-Busch and MillerCoors brands in their category. The biggest effect is a sharp jump in “Belgian Wits” share, due to the inclusion of Shock Top and Blue Moon.

- This is based on scan data, so it is a snapshot of the off-premise only (which accounts for only 60-65% of total craft volume and won’t have any data from brewpubs/microbrewery tasting rooms). This may reduce the share of smaller styles that are served on-premise but are less likely to be packaged.

- Not all beers fit neatly in a style category. A White IPA (already hard to categorize) that goes into a variety or seasonal pack will show up there, rather than in Belgian Wit or IPA.

- Not all 50 states are included in the analysis. The data includes 42 states and 47 different retail scan channels (some states have multiple channels represented).

So while this data gives a decent picture of state-by-state style data, it isn’t a comprehensive picture of the craft industry.

Variations by State

To get a sense of the variation that can exist state to state, let’s start by looking at the two largest styles for craft brewers – IPA and seasonal. Together these beer styles represent somewhere between 40-45% of craft volume (depending on what channel you are looking at/how you cut the data). But their share varies wildly state-by-state. In California (Multi-outlet plus convenience; MULO+C) seasonals have 9.8% share of craft, whereas seasonals have more than 30 share in Massachusetts (30.5% in MULO+C and 35.3% in Liquor). Similarly IPA ranges from 5.4% (Arkansas MULO+C) to multiple states with more than 30% share in various channels (Georgia-Liquor, Oklahoma MULO+C, and Utah MULO).

So what accounts for these variations? The obvious (and correct) answer is beer lover preferences. However, in order to be useful and/or predictive, we need to dig a bit deeper. One question that immediately arises is how these shares shift as craft develops across a state. Do we see a progression in share of certain styles and a corresponding loss in share of other styles as craft gains in share?

Note that a loss of share within craft doesn’t necessarily mean a loss of volume. In a growth industry, a rising tide lifts all styles, albeit at different rates. If craft grows from 10% share to 20% share of the overall beer market, a style that loses 5 or even 10 share points within craft can still grow its total volume significantly. For example, if craft holds 10% share of all beer and within craft Belgian Wits hold 30% share, that’s 3% share of all beer. If craft grows to 20% share and within craft Belgian Wits drop to 20% share, that’s now 4% share of all beer, which is higher volume. So we need to understand share gains and losses within the overall context of craft growth. It’s easy to get lost in share points and forget that what we really care about is increasing volume.

Ideally, you’d analyze the relationship between industry development and style preferences in two ways: single states over time (controlling for national shifts) and different states in comparison to each other in terms of development. Unfortunately, I don’t have any time series data to use the first approach, so we’ll have to settle for the second. So in comparing states, how do styles shift in share as craft develops?

Below is a table that shows a correlation coefficient (a measure of linear fit) between craft’s share of all beer across the states/channels in this data set and the top 10 craft styles in each of those states. These 10 styles represent almost 90% of total craft volume (national ranks may be slightly different). A higher positive number closer to 1 means as craft has higher share in a state, that style tends to also have higher share within craft. A negative number means that as craft grows that style tends to also have lower share within craft.

| Craft Style | Correlation with Share |

| IPA | 0.220 |

| Pale Ale | 0.168 |

| Variety | 0.104 |

| Fruit/Veggie/Spiced | 0.088 |

| Seasonal | 0.071 |

| Amber Lager | -0.103 |

| Amber Ale | -0.184 |

| Belgian Wits | -0.244 |

| Wheat Beer | -0.256 |

| Bocks | -0.277 |

As a whole, the data generally shows a picture of share moving from lighter and/or maltier beer styles to hoppier/variety-based packages. I should note that only the bottom three values are statistically significant (at a p<.1 level) and that there are some other methodological issues with running a correlation like this, but I digress.

Without being able to look at individual states over time, it’s hard to know how much of this relationship is:

- Causal: where growing share for craft and development of the craft industry causes beer lover preferences to change, versus

- A different places are different story: where the states that have developed the most are simply different than the places that haven’t – i.e. beer lovers on the West Coast like different things than beer lovers in the Southeast do.

If it is a causal story (which I suspect, but can’t prove), we can use the data to estimate what the development of the craft industry would mean for various styles, for instance IPA.

IPA Share Across the States

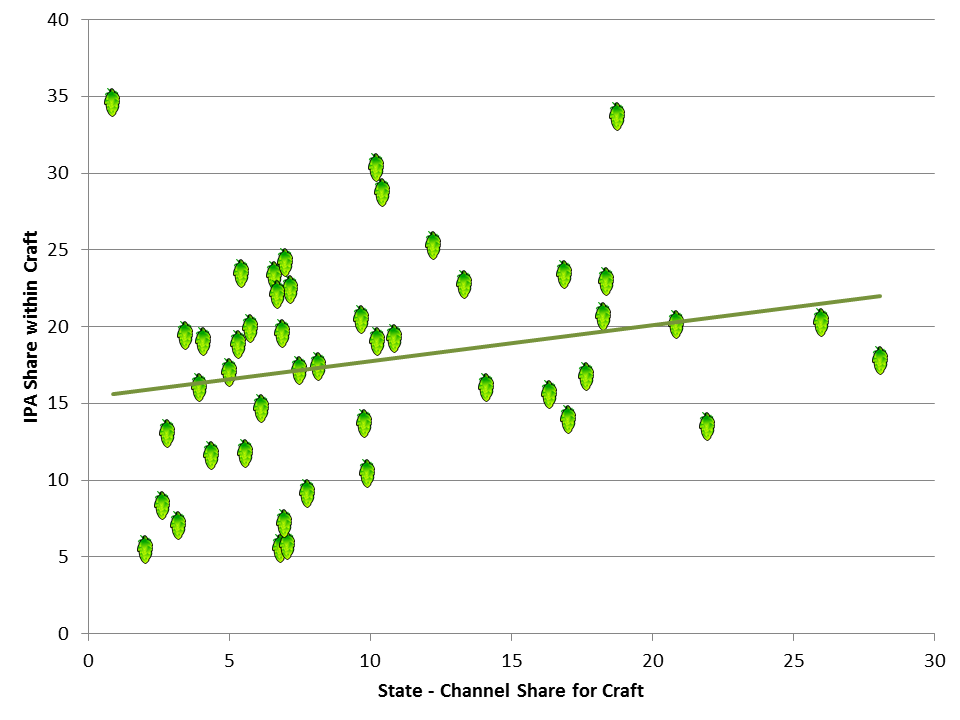

Below is a graph showing state craft share against IPA’s share within craft. Although there is a fair bit of variation, you can see that generally as craft share grows, IPA share also tends to grow. In fact, it predicts that on average, as craft grows from 5 share to 25 share, IPA should pick up more than 4.5 share points within craft. That may not be enough to dramatically shift business models (in a hypothetical million barrel state, 4.5 share points for a craft industry at 25 share is only 11,250 additional bbls), but it certainly matters at the margins.

To sum, I hope you take away two points from this post.

- State/local share of various styles matters a lot, and unless you’re a national brewer, national share shouldn’t drive your local strategy.

- There is some evidence that beer lover preferences may evolve over time as the craft industry develops in a state. While this point shouldn’t trump point #1 (know your local market), it is worth considering as you plan toward the future.

Resource Hub

Resource Hub