As every brewery knows, the pandemic changed just about everything about the way beer was sold and consumed in the U.S. in 2020. At the epicenter of those changes were on-premise bar and restaurant retailers. The on-premise has long been a critical channel for not only the beer industry, but small brewers in particular. Although less than 20% of beer industry volume is sold on-premise, for craft brewers that percentage rises to 40-45%, with an even higher percentage for the smallest brewers. Draught is often the first step into distribution that small brewers take, and craft’s share in the on-premise (30%+ by volume) greatly exceeds its share in off-premise (<10% by volume).

With that in mind, the Brewers Association Market Development Committee set out to talk with key on-premise retailers to learn about how their world has changed with the pandemic, what their plans are as they rebuild their businesses, what they want brewers to know, and how brewers can support their on-premise partners now and in the future.

Streamlining Offerings for Shelf Life and Surety of Supply

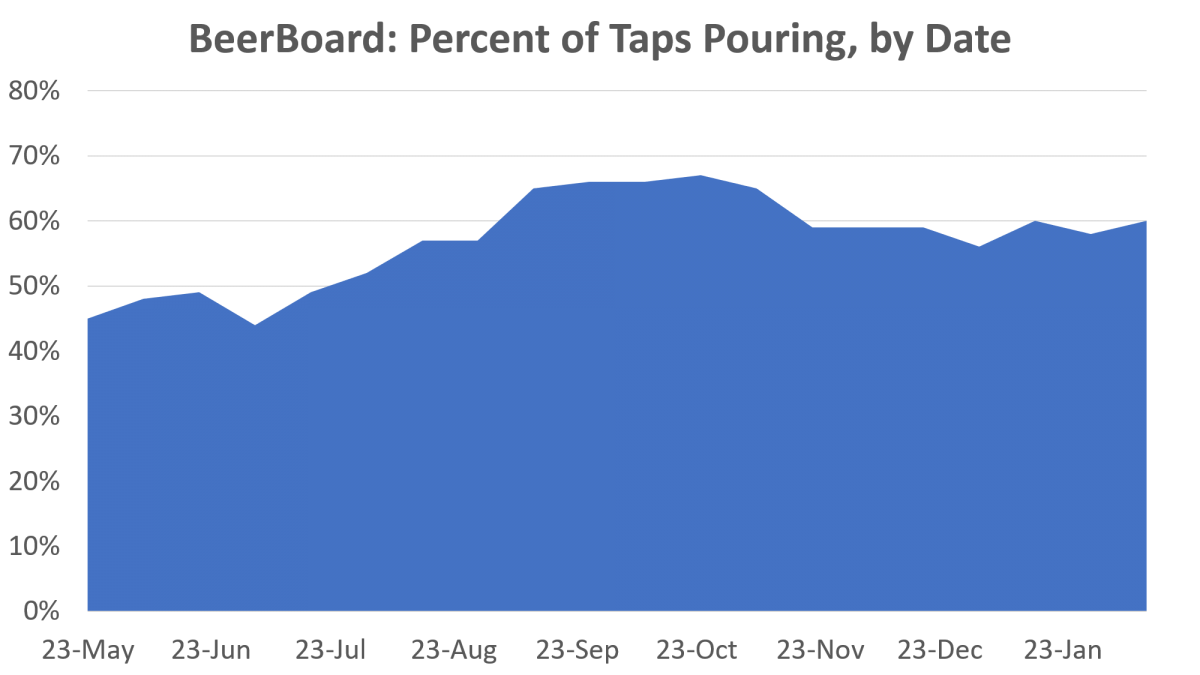

After the initial challenges of the shutdown (including seeing lots of beer go out of code and figuring out who owned the beer), all the retailers we spoke with made shifts in how their beer programs looked. The biggest was streamlining offerings. Several retailers mentioned slashing their tap handle number, and this has been born out in BeerBoard data throughout the pandemic.

In terms of what beers stayed, there were two major considerations. Rate of sale (keeping things on that would stay fresh and move quickly) and surety of supply. Rate of sale concerns meant reducing bottled and can options, and shifting those options into styles with longer shelf life.

For draught handles, while you might think retailers would look for more flexibility, one mentioned increasing their mandated handle number, simply because they needed to make sure they had beer, and picking suppliers where they were sure they could get supply for six months meant tightening their selection. As Josh Hurst of Pies & Pints put it, “we needed to ensure we could get consistent beer consistently.” Other multi-store retailers also simplified, with one noting they went from “four or five” menus before the pandemic to one.

In bars and restaurants, many other things were changed or scaled back as well. When asked about the pivot to to-go and delivery, there were a range of responses, both about their success and the future. Josh Hurst of Pies & Pints noted that beer-to-go wasn’t really part of their model and that it hasn’t been easy to transition. Some of this is regulation-based as there were hurdles in legality or finding partners for beverage alcohol delivery. John Lane of Winking Lizard saw similar challenges, as they didn’t do that much carryout before and what they did do was mostly food. They haven’t found a great way to execute beverage alcohol to-go, and even their best selling margaritas, just did “decent, not great.”

That being said, Jason Murphy of Buffalo Wild Wings says he saw enough success to hope to-go sticks around and thinks that the e-commerce from the on-premise channel can still grow even as in-store traffic comes back. To do that, however, he thinks they’ll need to think more about how to replicate their experience at home. New innovations are one of the keys to growing beer to-go.

Time to Pivot and Build Retailer Relationships

Retailers reduced third party partnerships, including tastings as trainings, simply to lower risks for workers and customers. John Lane of Winking Lizard was quick to compliment brewers that pivoted, noting that one brewer raised the bar with an online training program from staff for a new product. While it wasn’t the same as going table to table to trial and explain, it at least meant his staff was ready to talk about the new product.

In the medium term, the combination of lower handles and fewer sales opportunities means it’s probably a better time to build long-term relationships with retailers you want to work with than focusing on hard selling. Jason Murphy of Buffalo Wild Wings bluntly stated that now is “not the time to hard sell,” but at the same time now is a great time to reach out and build local relationships with your district manager. Josh and Jason echoed this sentiment, both that brewers hoping to sell into stores now should “lower your expectations” (Josh) and that this is still a relationship business. The fact that sales calls stopped from so many brewers was frustrating for John, particularly when he and his staff were still working the front lines. At the same time, the brewers that reached out and “showed a lot of empathy” are going to be at the front of the line when things reopen. So to the brewers who stopped calling on your on-premise accounts to check-in, the best time was yesterday, the next best time is today.

What do each of them see going forward? While no one expects business to be back to normal in the near future, each was cautiously optimistic or even optimistic for the back half of the year. While Josh from Pies & Pints again wanted brewers to “temper expectations,” he suggested that things were “starting to come back” and that in the context of seasonal trends (no one outside of Southern beach vacation spots kills it in January/February), they had seen some pickup in recent months. Checking in more recently, Josh re-iterated that things had continued to improve and wouldn’t be surprised if things were rolling by the end of spring. John Lane of Winking Lizard was seeing the same, and if December was 65% of last year, January was 80%.

Apprehension and Optimism for the Future

What will it look like when things pick back up? Here there was a healthy mix of apprehension and optimism. John Lane is worried about supply. If there are supply issues now with low traffic and a limited set of handles, what will things look like as things pick up. Brewers (and distributors) that can promise a surety of supply may have a better shot at being on tap when things do return. When they do, brewers would be wise to think about how they can add value for their retailer partners.

Different retailers saw different paths here. Jason Murphy suggested brewers should be thinking about how they can help provide an experience for people who have been sitting inside drinking the same beers for nine months. What are the new beers and experiences you can provide to retailers to help them draw consumers back in? While Josh agrees that events will be important once they can return, stylistically he’s seen a shift toward sessionable and approachable that he thinks is going to stick around. Given that divide, as breweries do their own sales planning, it makes sense to begin reaching to key retail accounts to see which side of this divide (variety/interesting versus core/approachable) they think they’ll fall on as they reopen.

To close, if there was one takeaway from all the conversations, it was that brewers should be putting in the time now to talk with accounts, build relationships, and start creating a plan for when things take off. As Josh put it, in an era with lots of good beer where “everyone wants to sell me an IPA,” especially coming out of COVID-19, it’s more important than ever to work with great people. Those that do may have the opportunity to reap large benefits. John Lane closed our conversation with his advice to brewers: “You better be ready. The pent-up demand is going to kill us in a good way.”

Resource Hub

Resource Hub