As we cross into the back half of 2022, there are a variety of swirling questions about the craft market’s present and future. The recovery from COVID-19 has been mixed based on geography, size, and business model, and the conflicting but increasingly negative signs about the short-term future of the U.S. economy beg the question of how much longer craft’s recovery can continue.

To that end, the best indicator of how craft brewing is doing comes from you, the brewers! Please take a few minutes to fill out our midyear survey. It’s anonymous (we ask for brewery name just to avoid double counting and to get proper weighting) and even shorter than our annual survey:

Before we have that data in hand however, we can turn to other indicators that provide pieces of the puzzle.

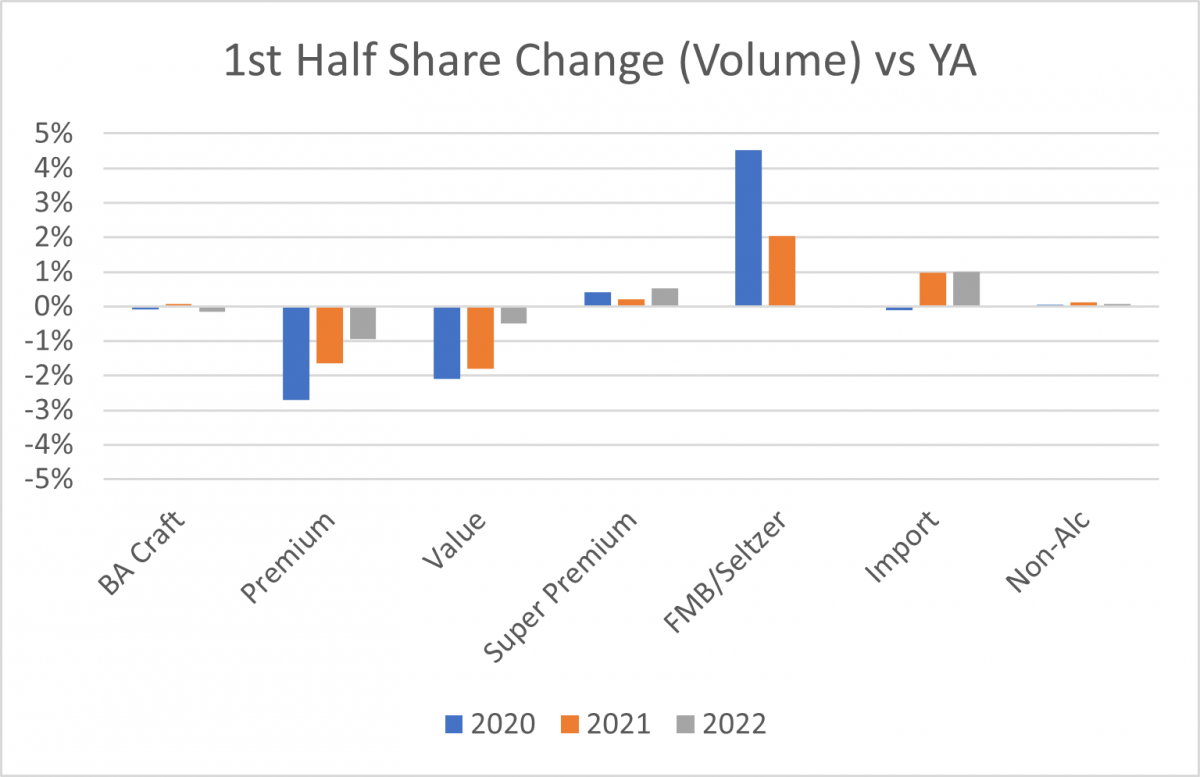

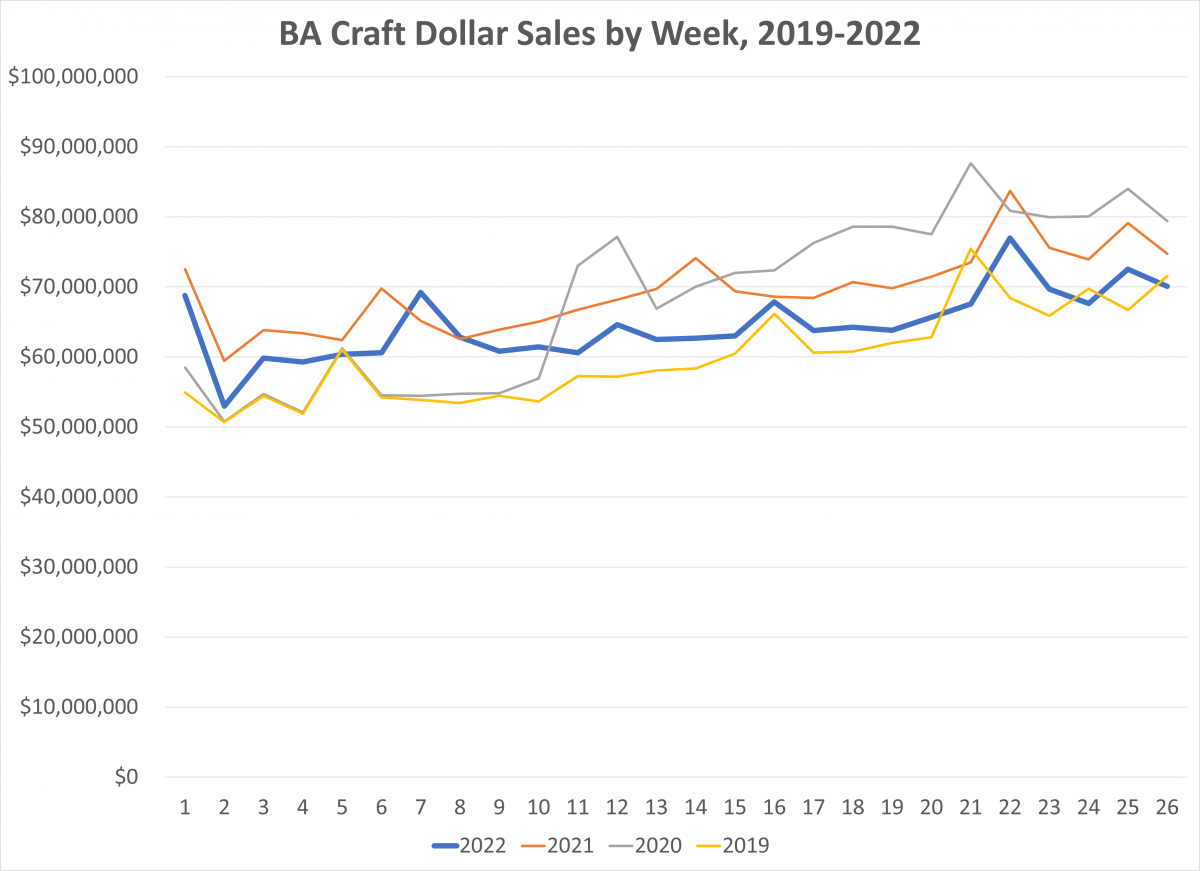

Scan Data Shows Weak Start to 2022

First up is scan data, which I might summarize with the words “underwhelming” or even “concerning” depending on your point of view. To frame the data in some context, total beer volume sales were down 6.5% in the first half of the year, and dollar sales down 2.0% versus a year ago (IRI Group, total U.S., multi outlet with convenience (MULO+C) +total liquor). This shouldn’t be overly shocking given that, A) the comps for packaged sales in the first half of 2021 were clearly still elevated (10% above 2019 by volume and 20% in dollar sales), and B) the on-premise in the first half of 2022 was much stronger than the first half of 2021. On point B, the relatively strong second half of 2021 makes it easy to forget how much the on-premise was still recovering in the first half of 2021, meaning that some of the dynamics we’re seeing when looking at year-over-year numbers this year are still relative to channel shift.

Given that context, craft’s struggles in scan in the first half of 2022 should be viewed somewhere in between expected and alarming. The expected viewpoint would note that given the importance of the on-premise for craft, you might expect channel shift to effect craft more than other segments (I’ve previously suggested, partially in the vein of intentional provocateur, that during the recovery negative scan trends might be a good thing for craft). Add in the fact that craft share was only down slightly versus a year ago and that dollar sales are still above 2019 and you can make a case that the numbers are kind of what you’d expect.

Source: IRI Group (Total U.S., MULO+C+Total Liquor). Brewers Association Analysis.

The more pessimistic take would note that even if channel shift explains the weak overall volume and dollar trends, at best, there clearly is very little momentum behind craft beer at chain retail at the moment, continuing a string of several years where this is the case. At worst, scan volume was basically at 2019 levels (0.1% higher) in a first half where distributed draught was pretty clearly still weaker than it was pre-pandemic. At-the-brewery sales might make up some of that gap, but regardless, chain packaged independent craft hasn’t grown over the past three years. And with ready to drink (RTD) spirits and a variety of other fourth category products coming for craft’s shelf space, it’s hard to see a lot of momentum for changing that trend anytime soon.

Source: IRI Group (Total US, MULO+C+Total Liquor). Brewers Association Analysis.

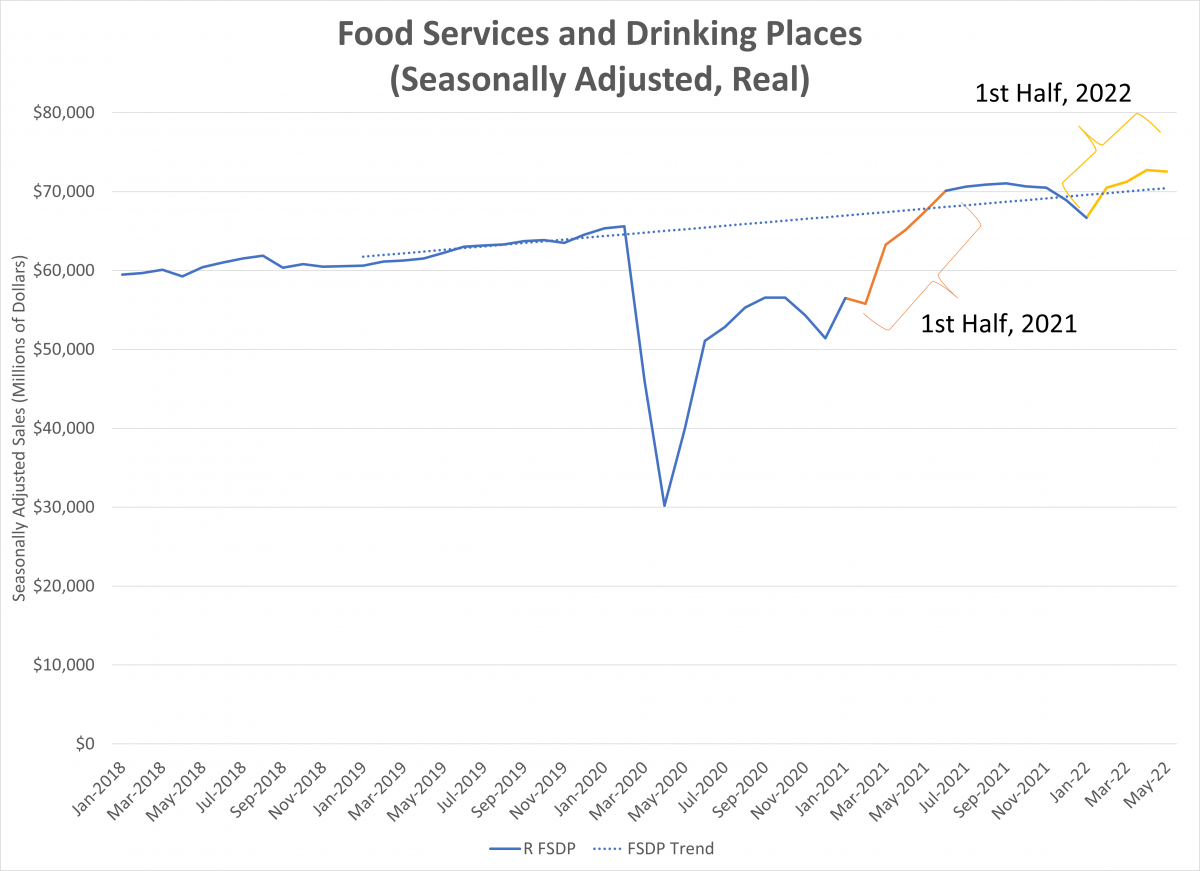

On-Premise and Draught Trends Looking Up

The real open question is how much improving draught and onsite trends might be making up for package weakness (and how much non-measured distributed package might look different). Reminder: that’s where our survey comes in! Take two minutes and fill it out!

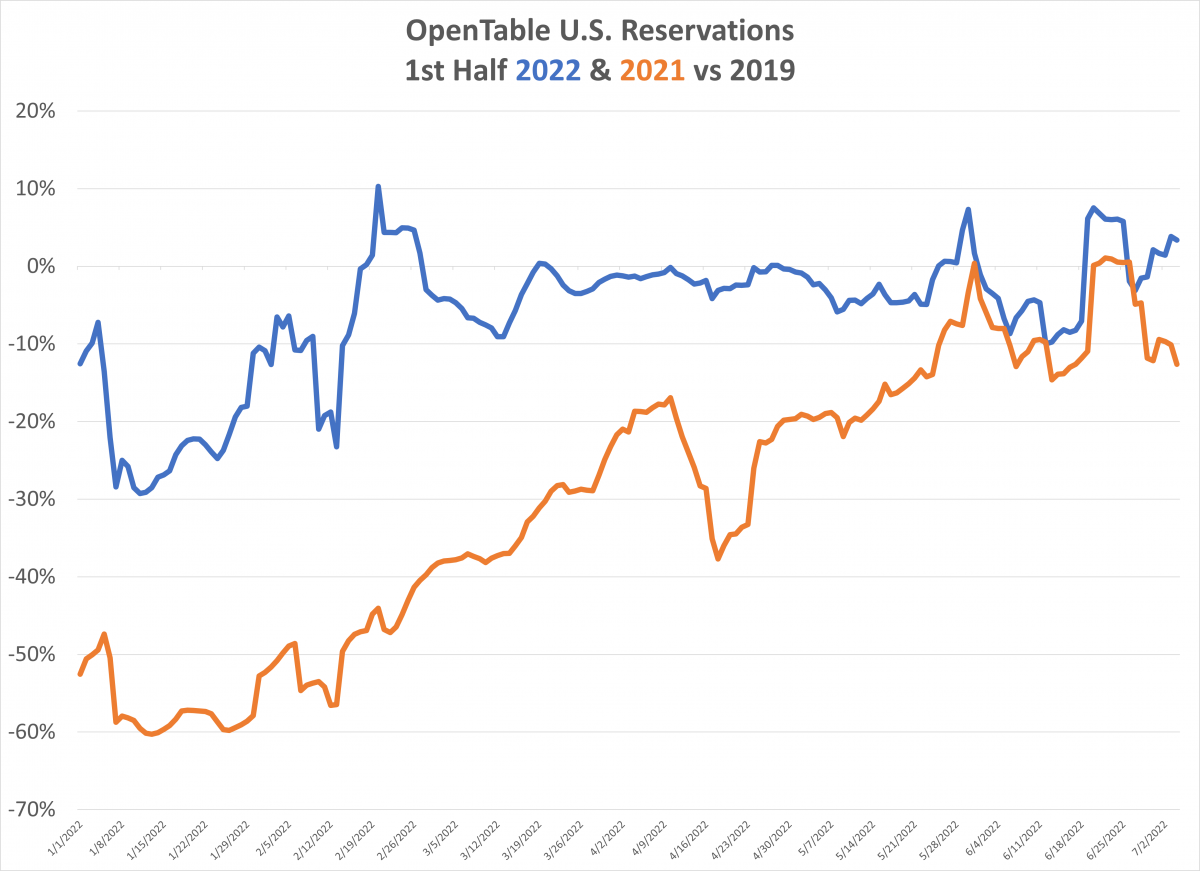

We have a few hints from other data sources, such as retail census data, that shows foodservice and drinking places sales up 15% in real terms versus last year (24% before controlling for inflation). Similarly, Open Table reservations were only 6.2% below 2019 in the first half of 2022, versus 30.5% below 2019 levels in the first half of 2021.

Source: U.S. Census Bureau; Monthly Retail Trade. Brewers Association Analysis.

Source: OpenTable, Seven-day Average. Brewers Association Analysis.

Both of these indicators show that the on-premise trends have improved, but draught sales won’t track perfectly with either of these numbers due to changes in restaurant composition and consumer buying patterns, so surveying will give us a more accurate picture (at least until we get updated TTB data, which hasn’t been updated so far in 2022).

In closing, craft has benefited in the past year from the return of on-premise. In that context, weak scan data in the first half falls somewhere in between a continuation of good news and a sign of future weakness. Draught certainly grew in the first half versus a year ago, but we won’t know how much until we have better data. And while I’m confident at-the-brewery sales are still growing, I’m less confident they are growing fast enough for everyone to be growing, particularly given continued brewery count growth.

More to come on all these topics, plus more on the American economy on July 28 when I present the results of our midyear survey in a member-only BA Collab Hour webinar—Register now!